The financial world is undergoing a significant transformation, and at the heart of this revolution is Decentralized Finance (DeFi). This innovative technology is reshaping the way we think about money, investments, and financial services. In this article, we will explore what DeFi is, how it works, its benefits, and the challenges it faces.

What is Decentralized Finance (DeFi)?

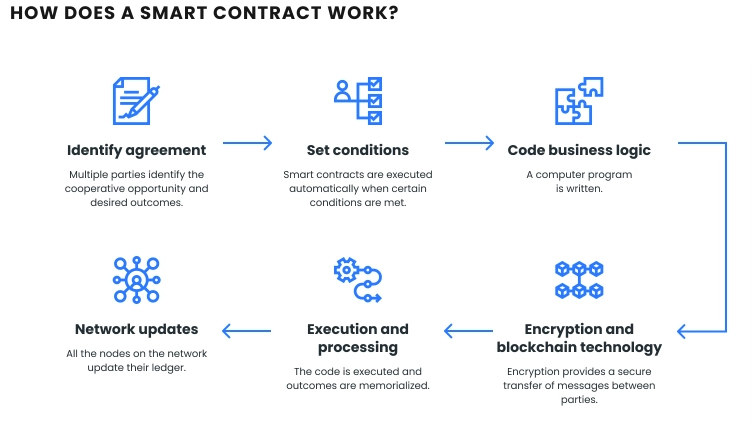

Decentralized Finance, commonly known as DeFi, refers to a collection of financial services that operate on blockchain technology. Unlike traditional finance, which relies on centralized institutions (CeFi) like banks and brokerages, DeFi uses smart contracts on blockchain networks, such as Ethereum, to provide financial services. These services include lending, borrowing, trading, and earning interest on crypto assets, all without intermediaries.

How Does DeFi Work?

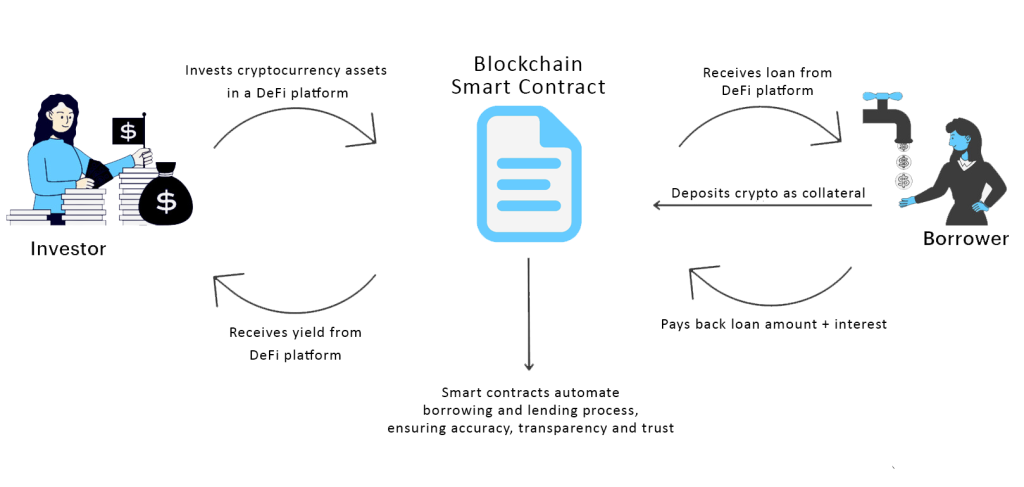

DeFi platforms use smart contracts to automate and enforce the terms of financial transactions. Unlike traditional finance which has intermediaries like loan officers, underwriters, etc, smart contracts are self-executing with the terms of the agreement directly written into its code. Once deployed on the blockchain, smart contracts operate transparently and autonomously.

Example: Lending and Borrowing on DeFi Platforms

- Lending: Users can lend their crypto assets to a DeFi platform and earn interest. The smart contract ensures that the lender receives interest payments and can reclaim their assets at any time.

- Borrowing: Users can borrow crypto assets by providing collateral. The smart contract manages the collateral and loan repayment, reducing the risk of default.

Benefits of Decentralized Finance

DeFi offers numerous advantages over traditional finance, making it an attractive option for many users worldwide.

- Accessibility: DeFi is open to anyone with an internet connection, removing barriers to financial services for unbanked and underbanked populations.

- Transparency: All transactions are recorded on a public ledger, ensuring transparency and reducing the risk of fraud.

- Control: Users retain control over their assets at all times, as they interact directly with smart contracts without intermediaries.

- Innovation: The open nature of DeFi encourages innovation, leading to the development of new financial products and services.

Challenges and Risks of DeFi

Despite its many benefits, DeFi is not without challenges and risks. Understanding these can help users make informed decisions.

- Security Risks: Smart contracts are susceptible to bugs and vulnerabilities, which can be exploited by hackers.

- Regulatory Uncertainty: The regulatory environment for DeFi is still evolving, and future regulations could impact the industry significantly.

- Market Volatility: The value of crypto assets can be highly volatile, affecting the stability of DeFi platforms.

- Complexity: Navigating DeFi platforms can be complex for new users, requiring a steep learning curve.

Also Read: The Future of Money: Exploring Solana

Popular DeFi Platforms and Applications

Several DeFi platforms have gained popularity due to their innovative services and user-friendly interfaces.

- Uniswap: A decentralized exchange (DEX) that enables users to trade cryptocurrencies directly from their wallets.

- Aave: A decentralized lending and borrowing platform that allows users to earn interest on deposits and borrow assets.

- Compound: A DeFi platform that allows users to lend and borrow crypto assets, with interest rates determined algorithmically.

- MakerDAO: A decentralized platform that offers the Dai stablecoin, which is pegged to the US dollar and backed by collateral in the form of other cryptocurrencies.

The Future of Decentralized Finance

The future of DeFi looks promising, with continuous advancements in technology and increasing adoption by users worldwide. Innovations such as Layer-2 scaling solutions and cross-chain interoperability are expected to enhance the efficiency and accessibility of DeFi services.

Potential Developments:

- Interoperability: Enabling seamless transactions across different blockchain networks.

- Scalability: Improving transaction speeds and reducing costs through Layer-2 solutions.

- Enhanced Security: Developing more robust smart contract auditing and security measures.

- Mainstream Adoption: Greater integration of DeFi with traditional financial systems and services.

Also Read: How Crypto Adoption is Breaking Barriers

Embracing the DeFi Revolution

Decentralized Finance (DeFi) represents a new era in finance, offering unprecedented accessibility, transparency, and innovation. While it comes with its set of challenges, the potential benefits make it a compelling alternative to traditional financial systems. By staying informed and taking necessary precautions, you can harness the power of DeFi to achieve your financial goals.